To start we’ll need to explain the words within the acronym – Non-fungible Token

Non fungible means unique and irreplaceable. There’s only one of them, for example Jacy Dorsey’s first ever Tweet.

There’s only one first Jack Dorsey tweet, it can’t be swapped for another, its not interchangeable. Like the Mona Lisa or the great sphinx.

At its core an NFT is a digital certificate that serves as proof of ownership of a digital or real world asset. The asset can be anything from digital art, to music, real world art, digital and real world collectables, videos, virtual fashion, domain names, memes and even property deeds.

Why are they so expensive?

The value of NFT’s comes from a few factors, two of the most prominent being their utility and the hype. The NFT marketspace is driven by hype, with many owners speculating on the value of the NFT increasing over time based on demand. Hype is what is driving the avatar, image based NFT’s.

For us marketers, the relevancy and value proposition lies in the utility. As mentioned earlier NFT’s are proof of ownership, the ownership entitles the owner to some benefits = that’s utility.

Utility ranges from giving the NFT owner access to exclusive events, online content (video game assets and livestreams amongst others). Utility can even lie in intangible benefits… clout, social proof through owning a digital asset.

How can brands use it?

Most brands are currently exploring the NFT world through Digital asset ownership, the players in this space tend to be luxury fashion brands. Others are hedging on the Metaverse to bring “life” and value to their NFT’s.

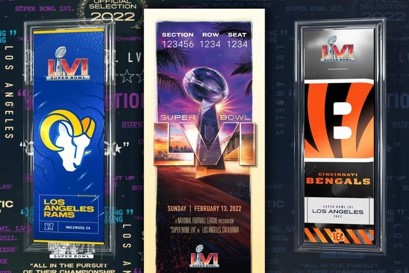

Event and exclusive community access is where we see the greatest value proposition. Having your customers/consumers/shoppers own a branded NFT in exchange for access to an exclusive community. Event ticketing is also an emerging NFT trend as seen at this years Superbowl where all ticketholders got an NFT specific to their seat/section

From a Nam perspective, it is an emerging trend and one to be aware of, for early movers getting a foot in the door and establishing platform dominance would be an upside. But… we certainly don’t have the masses on board yet to warrant immediate big investment.

Experimentation is encouraged!